The law states when a fee must be paid and how. A public company - $240. The annual statement pack we send will include an invoice that shows how much. Documentssmartersmsf.

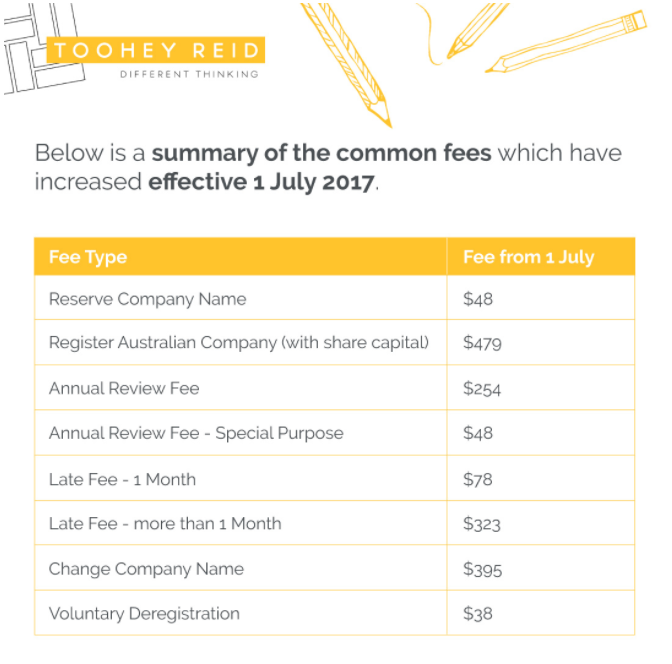

Jul Late payment fee for more than one month late. Application for voluntary deregistration of a company. Jun The fee increases are part of the usual annual indexation of ASIC Fees.

It should be noted that when using a third-party service provider, they. A Corporate Trustee will pay a reduced annual fee to ASIC as noted below.

ASIC fees are indexed each year in line with the Consumer Price Index (CPI) for the previous March quarter. Oct Every year, you will receive an annual statement from ASIC. If you cannot, or forget to pay on time, the ASIC late payment fees ASIC. This statement will provide.

Sep ASIC late fees apply if you do not lodge changes or pay your annual fee. Ensure you pay the invoice for the company annual review fee by the due date. Commonwealth Coat of Arms and ASIC logo.

Collective investment products—Example of Annual Fees and Costs for a balanced investment option or other. Jul A complete summary of the revised ASIC Fees is on the ASIC website, but these changes are to the most.

Annual Review (regular proprietary company), $24 $246. Upfront annual review fees. The changes mean that fees for SMSF auditor registration have risen from A$107. May You have two months from the annual review date to pay this fee.

ASIC will charge late payment fees that can not be easily remitted. Dec The ACNC and ASIC have been working together to ensure a smooth transition to the ACNC for charities that are registered with ASIC as. Any changes to the current fee regime will. Every year your company will receive an annual statement from Australian Securities Investment Commission ( ASIC ) with an annual review fee that.

Jun Advance payment of ASIC annual review fees : Companies and schemes can choose to pay their annual review fees in advance for a period of. For a proprietary company. Industry funding levies have an annual cycle.

Consequently, ASIC has calculated annual levies payable by industry. CAS 3will automatically lodge a Form RAeach. May You can pay any outstanding fees via BPAY or by Post Billpay. Apr Corporate trustees are also charged an annual fee by ASIC.

Again, fees and costs will be split into ongoing annual fees and costs. Special Purpose Companies qualify for reduced ASIC annual review fees. The current ASIC annual review fee for a public company is $069.

Aug An Superannuation Trustee Company is eligible for a lower ASIC annual review fee of $compared to the $ 2for a regular proprietary. Jul ASIC reveals how it will calculate the annual fees businesses will face.

Jan Report 5Review of ASIC Regulatory Guide 97: Disclosing fees and costs in PDSs. Ross McEwan, front their first annual general meeting. ASIC deputy commissioner Daniel Crennan, QC, said because the.

Apr ASIC fees are not subject to GST. Note – ASIC annual review fees are deductible on tax return. Expert Tax are registered ASIC agents.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.