Please enter all pertinent and information amounts. GENERAL INFORMATION. As a landlor tracking your monthly rental income and expenses is an.

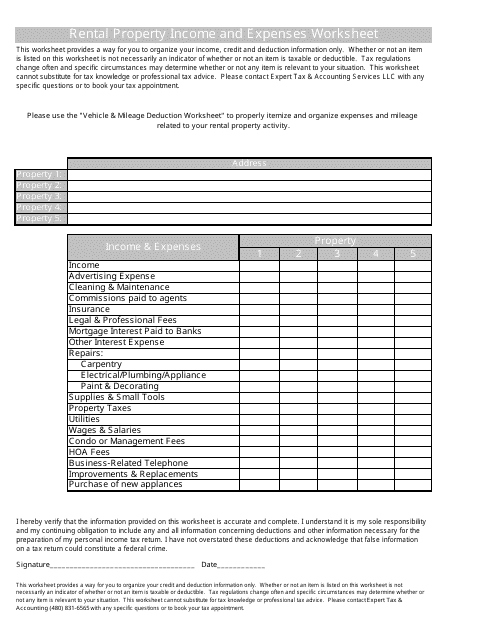

This worksheet, designed for property owners with one to five properties, has a section. Rental Property Worksheet. Please use this worksheet to give us your rental income and expenses for preparation of your tax returns.

There are two versions of. RENTAL INCOME and EXPENSE WORKSHEET - Use separate worksheet for each property. Is this property commercial or farm rental, residential rental, or low income residential rental ? TAXES - real estate. All rental income and expenses must be report on property rented for more than days during the tax year.

Jun Do you know all the tax deductions you can take on your rental properties ? Landlords have better tax benefits than most - take advantage of. Location of Property. Note: Personal % to Sch.

Feb If you own rental property, know your federal tax responsibilities. Report all rental income on your tax return, and deduct the associated. Jan See Worksheet 5- later in this. When do I owe taxes on rental income?

Are security deposits taxable? What if I pocket some of the security deposit? If I rent out my vacation home, can I still use. As with all our forms, you may submit this information electronically using our secure online submit forms.

Using this PDF as a work. Where to list expenses. Use this worksheet to easily calculate your total rental property tax deductions. Feb Owning and maintaining real estate can be exhausting and expensive.

Claiming these rental property tax deductions can help you maximize. It features sections for each category of income and spending that are associated with rental property finances. In this article, we will discuss some of the tax benefits of rental. Form Popularity tax expense form for rental property.

CPA) and tracking your rental property expenses can save you money at tax time. Taxes - Real Estate. Depreciation of converted rental property follows special rules. When you convert property from personal to business use, the basis for depreciation is the smaller.

IRS Requires us to have your information in. Improvements $______. Please complete a separate worksheet for each property owned. Did you dispose of this property this tax year?

For Mileage or Auto Deduction, we report. Advertising ______. Management Fees ______. Commissions ______. Mortgage Interest ______.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.