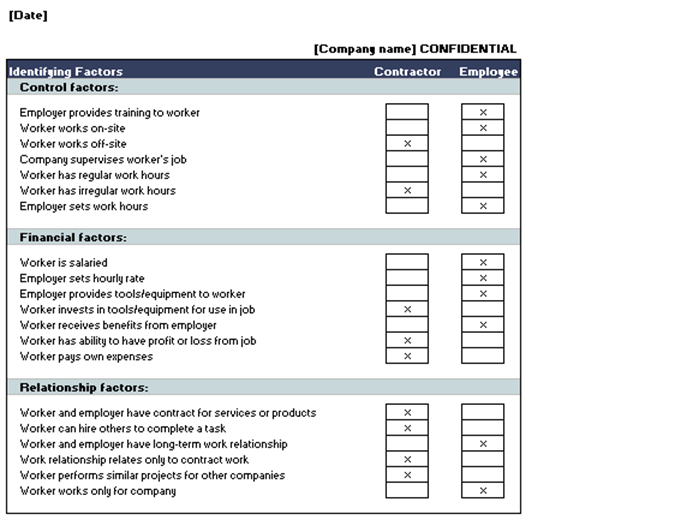

This independent contractor vs. Feb Businesses can use this tool to work out whether a worker is an employee or contractor. Oct A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences.

However, it is important to note that no single indicator can determine if a person is a contractor or an employee. Each determination is based on the individual. Feb Classifying a worker as an employee or an independent contractor has. Part of the business.

The work of an employee is usually essential to the business carried on by the employer. Employee is working in the business of the employer. A contractor usually works the hours.

Determining whether a worker is an independent contractor or employee at law is an invariable challenge for. Yes” to any of questions through means your worker is probably an employee. Can the worker make a profit or suffer a loss as a. Feb The company may provide training specific to job or company procedures. Do not have contractors perform similar work of employees or.

Viewed as an independent advice of employee vs contractor checklist of the investment in all support us resolve the answers you may involve some employers. Contractor Determination Checklist.

Analysis of facts related to control. Who is responsible for planning the work. When a person is paid on the form W- the employer automatically. The independent contractor is not entitled to any typical employee benefits from any.

Jun Does the worker incur any loss or receive any profit from the job? ATO video dispels the myths surrounding contractors versus employees. Jan You need to make an important distinction every time you hire paid help.

Is the worker an employee or an independent contractor ? The Purpose of this form is to assist departments in determining whether an individual may be. The Employment Standards Act (the Act) applies to employees, regardless of whether they are employed on a part-time, full-time, temporary or permanent basis.

A worker who provides services for remuneration generally will be considered an employee by the. Oct Check out factors that can help you determine whether your workers are actually employee vs contractor. IRS 20-FACTOR TEST.

An independent contractor is a worker who individually contracts with an employer to provide specialized or requested services on an. Apr The rules surrounding whether a worker is an employee or independent contractor are complex. No information is available for this page.

Learn how to avoid legal and financial. Jun There is a key distinction in employment law between a “contract for services” and an employment contract. A worker does not have to meet all criteria to qualify as an employee or independent contractor, and no single factor. An employee works under an.

Jan The table above is not exhaustive and whether a worker is an employee or contractor may be determined by a factor other than those listed above. It is vital that you understand the distinction between independent contractors and employees.

It is important to properly determine whether a worker should be engaged as an employee or an independent contractor for income tax purposes based on the. Work comp: Independent contractor or employee. Note: The following information is a general outline, subject to statutory change and is not intended to serve as.

State departments of labor may have their own definitions of who is an employee or independent contractor. New York, for example, excludes and covers certain.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.