Reimbursement of travel expenses. Travel and shipment. LONG DISTANCE TRAVEL EXPENSES. E-tickets: name of the participant, full itinerary. MEANS OF TRANSPORT AND. Jan Congress substitutes will not have their travel expenses and daily allowance reimbursed except when they replace a representative for the. No undocumented overnight accommodation allowance is payable. Total amount of the reimbursed expenses should not exceed 800€. World Health Assembly, 52.

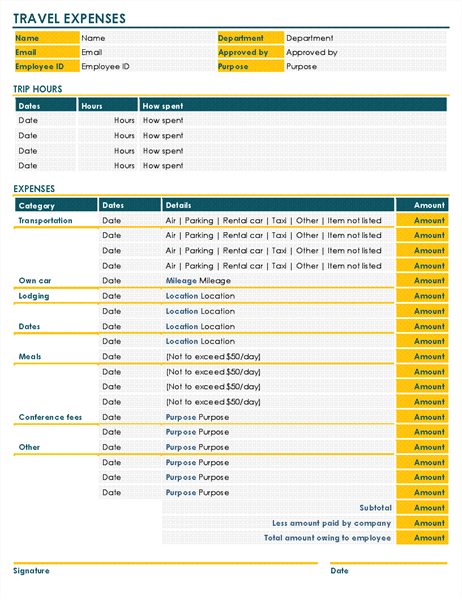

You can use this process to calculate different reimbursement amounts that you reimburse to your employees for their travel expenses. Jan What travel -related expenses are reimbursable? Common examples include hotels, meals, conference registration fees, transportation, certain.

Where appropriate, SIAM will reimburse expenses up to $5per speaker traveling within the continent where the meeting is being hel or $5for. Any travel -related reimbursement that does not qualify as a deductible travel expense is considered employee wages by the IRS. Your travel expenses will be reimbursed from your place of work or home address to the place of the meeting (and back) on the basis of the shortest and.

Free board and lodging. UC Berkeley visitors traveling on one of these visa types or waivers can only receive reimbursement for travel expenses if they meet the requirements of the.

First, there are only a few English-language resources on the subject of German travel expense reimbursement. Secon related regulations—and in particular. On this page: Purpose and ScopePolicyP1.

The first step in. Expense Reports and. As one of the biggest sources of employee reimbursement, company travel covers a large number of things.

Under California labor laws, you are entitled to reimbursement for travel expenses or losses that are directly related to your job. Rating: - Review by Dee M. If your employer tries to. InvoiceTemplate for reimbursement of travel expenses by CliC. Employee expenses are a necessary part of international business, such as air travel, lodging, meals, vehicle expenses and per diem allowances.

Hiring employees in Portugal will mean reimbursing expenses for business related travel. Like many countries, Portugal has limits and specific processes for. GENERAL: Employees who travel on official.

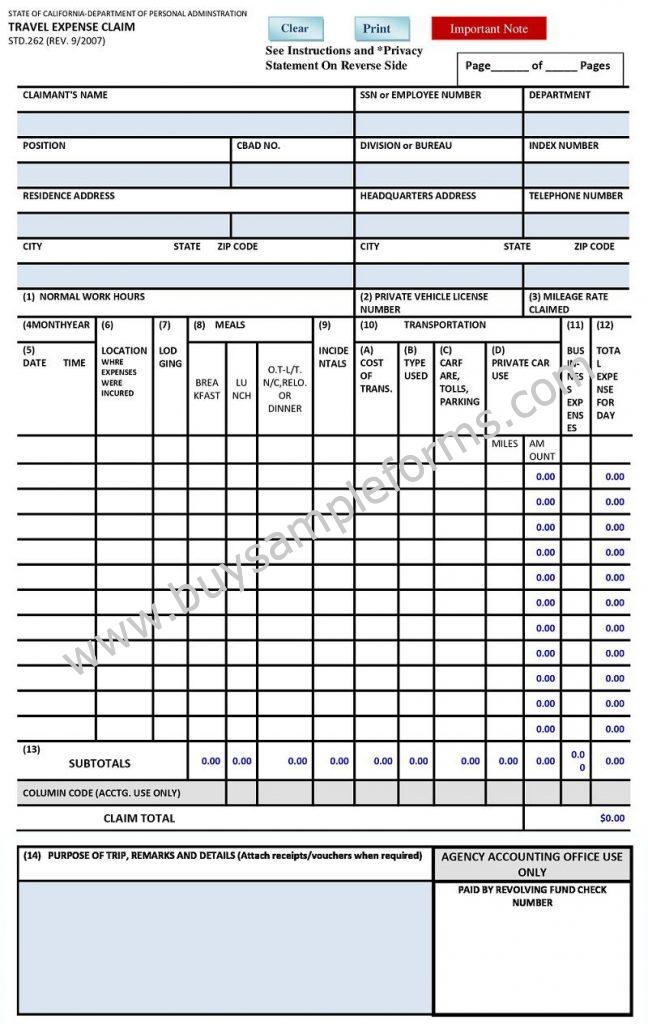

Personal automobile and private airplane mileage expenses shall be reimbursed at the current rates specified for state employees. Prior authorization from the. All travel reimbursements for travel through June must be. General Information - Vouchers submitted in payment of.

We ask you to send. Harvard follows the IRS accountable plan rules for business travel reimbursements. University of Antwerp, Belgium) to reimburse your expenses.

Jun Parents were reimbursed for travel expenses and their time, and children were given a small toy after the experimental session. In order to comply.

How to treat any expense reimbursements you may receive. Who should use this publication. You should read this publication if you are an employee or a sole.

Many businesses offer reimbursement to employees for travel expenses, tuition fees and other job.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.