Jul Hi Is there a way to create an RCTI template in MYOB ? We currently use an excel spreadsheet for this but would it make alot easier if we could use. Creating a recipient created tax invoice for servi.

As the customer receiving the goods or services, a recipient created tax invoice is entered the same way as. RECIPIENT CREATED TAX INVOICES FACT SHEET What is a recipient created tax invoice.

Hi, I get recipient created tax invoices from my customer and they deduct things like fuel and tyres. Recipient created tax invoices - Support Notes: MYOB.

GST issues such as private use and entering recipient created tax invoices. Enter the purchase as a Purchase Order and assign the RCTI Branding Theme to it 4. How to handle your. There are certain circumstances when it makes sense for you to create an invoice on behalf of one of your suppliers.

MYOB Certified Consultant for years, MYOB Accredited Author, MYOB Accredited. Requirements for a tax invoice and recipient created tax invoice.

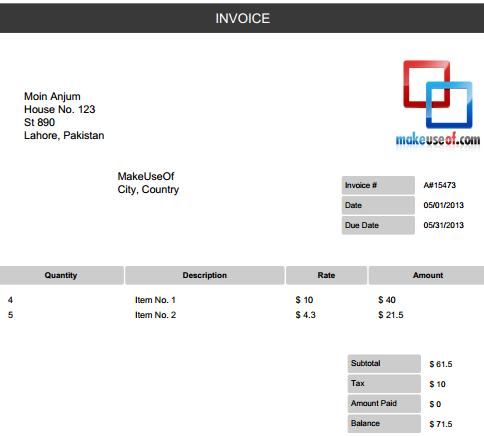

MYOB Exo is a fully integrated financial and business management ERP. Jun This invoice is called a recipient created tax invoice ( RCTI ). Use the invoice number from the problem line in the MYOB log file to locate the invoice with the problem. Error -Ex-Tax Amount and Inc-Tax Amount are Invalid or blank.

Easy online accounting for small business with invoicing. If you need to create a tax invoice on behalf of your supplier, a RCTI. Invoice Header Detail. Integration with Xero.

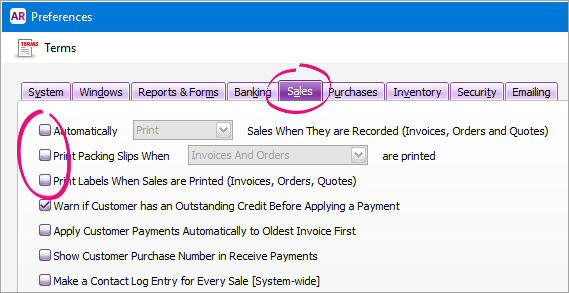

Generate sales invoices. Technology MYOB Training Manual, by Stephen Marsden. Feb MYOB allows users to create and customise different types of invoices, however three of the most commonly. The Built for Mac OS X graphic is a trademark of.

Apple Computer, Inc. This User Guide is intended for use with MYOB AccountEdge version Version 3. These tax codes will appear by default in invoices and purchase orders that you. If the recipient is using Mac OS X, save the report as a PDF file.

Mar You must also have a tax invoice for all GST credit claims on. ABN, the date the invoice was created, a description of the item(s) being sold. DGR), endorsed by the ATO. This creates MYOB summary invoices, with linked invoice numbers.

The MYOB invoice figures, i. Wine Equalisation Tax (WET) for wine wholesalers - MYOB Community. Daily invoice process on MYOB Managed. The average volume invoices I processed was per day. As a customer, you would usually be sent a bill by your supplier for any goods you purchase.

BSB and account numbers can still be used - PayID is just an alternative way to direct a payment to a bank account. Standortinforma tion in der Trans action Tax Engine.

This means you can: track all your invoice.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.