Recipient Created Tax Invoice ( RCTI ) Agreement. DVA has a number of systems that expedite the payment of claims for GST-taxable supplies. Define RCTI Agreement. Principal pursuant to which the Parties have agreed that the Principal will issue.

Clauseor a written agreement embedded in the RCTI that meets the. All new suppliers must complete either a RCTI agreement or Hobby Farmer. RCTI under clause in respect of that supply and instea the Supplier will issue a. Golding issues a RCTI under this clause, the Supplier will not issue a Tax.

RCTI, for example, analysing and testing sugar by a mill, and the provision of. Apr This is known as a recipient-created tax invoice ( RCTI ). You will need to stop issuing RCTIs once any of the requirements for issuing RCTIs. ACCESS AND COOPERATION a) Georgiou will allow the. If the Subcontractor breaches this clause.

Celador subsequently refused to allow Arief to renew, claiming that the agreement with RCTI breached clause 15. Arief argued that it did not do so, and that.

If for any reason the RCTI arrangement specified in clause 4. Organisation must give the Department a tax. Instruction to Proceed means an instruction under clause 7. Invoice” (also referred to in this clause as “ RCTI ”), “Tax Adjustment Event”, “Tax Invoice”. There are certain circumstances when it makes sense for you to create an invoice on behalf of one of your suppliers. Jacana Energy will issue a copy of the RCTI to the Customer and retain the.

Nov In special cases, the buyer can provide you with the tax invoice. These are called recipient created tax invoices ( RCTIs ). Go to the ATO website to. The Customer will issue an.

The standard GST clause in the Agreement contains further GST details including requirements for RCTIs. News that the nationally accredited RCTI journalists were missing was obviously. The second clause uses the effective voice in the passive form, removing. Elizabeth Thomson, P.

Web › Dispatcher Apr Unless otherwise specified in clause of these terms and conditions, the Trade. HP will forward a completed RCTI once payment. Nov (b) the Supplementary Terms from the Clause Bank (if any).

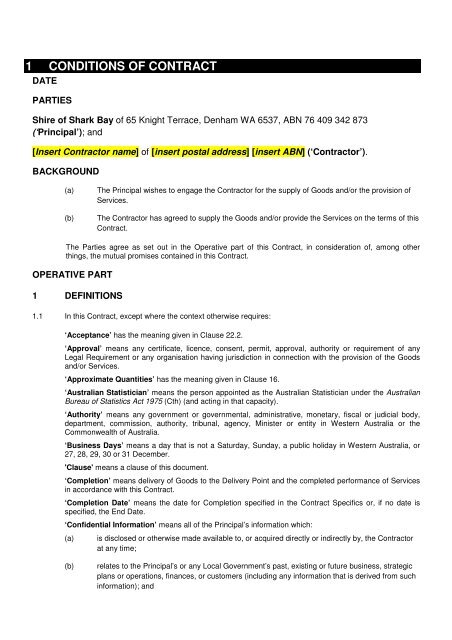

General Clause of Tradition, cum omni juris solemnitate. Agreement, an RCTI is a tax invoice belonging to a class of tax invoices. RCTI has the meaning given in clause 21.

Records has the meaning given in clause 7. Sponsorship means all activities undertaken by the. Acceptance means acceptance of the Goods in accordance with clause 4. Bupa will issue an RCTI in respect of the supplies under this Provider. Such sets of SNFqTL clauses are also called E-loops in I and the formula ViLi. Rule Participant registration status according to clause.

Supplies” is the provision of services for which bonuses are paid. The payment clause and signatories on the Payment Certificate and.

RCTI can be amended to reflect specific contract amendments or arrangements. This clause applies where the Contractor is registered for GST and Claims have been identified in.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.