Jul As used in this unsecured promissory note (this “Note”), the following terms shall have the following meanings: “Affiliate” as to any Person. Prior to the date that the Principal hereof is due and payable (whether at stated maturity or by acceleration), this Note shall bear interest at a rate of 1. An unsecured promissory note is an obligation for payment without any property securing the payment.

If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. The non-collateral promissory note is an unsecured loan that does not use any property or assets to secure the repayment of the note.

These types of promissory. In fact, prototypes for the modern promissory note may date back to the 10th century or. Apr A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money.

Applicant proposes to issue, ( ) unsecured promissory notes in the sum of not exceeding $, 0, 0in aggregate principal amount at any one time. It is designed for an unsecured loan, and it requires that you calculate the. Installment Payments). Muchos ejemplos de oraciones traducidas contienen “ unsecured promissory note ” – Diccionario español-inglés y buscador de traducciones en español.

New Lines of Credit") in amounts up to the. Document › View › FullTextcontent.

If a promissory note is not backed or secured by any type of collateral, then you cannot take anything from the. But, there are two things to keep in mind – its current value and future value. Promissory Notes, Drafts and Checks. If the loan is secured by a form of collateral, you can exercise your legal right to seize those assets.

However, an unsecured promissory note offers no collateral. Other Business Contracts, Forms and Agreeements. Jun Unsecured promissory notes can be especially challenging to enforce, because they often involve not only a lawsuit, but further post-judgment.

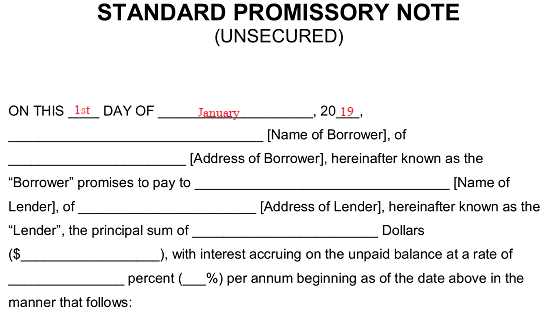

Secured and unsecured loans. UNSECURED PROMISSORY NOTE. Caution — It is important that you thoroughly read the contract before. Borrower will pay to Lender.

Jan CSAs and unsecured promissory notes are two common methods of financing a farm. De très nombreux exemples de phrases traduites contenant " unsecured promissory note " – Dictionnaire français-anglais et moteur de recherche de traductions. Company owed to one subscriber for a convertible unsecured promissory note (the “Note”). Sep When the promissory note is unsecured one, the payee can file suit for injunction, demanding to direct the payer to pay the amount.

Lending money to family or friends? Quickly print or download your customized IOU for free. A short-term unsecured promissory note issued by a finance company or a relatively large industrial firm.

The notes are generally sold at a discount from face value. Solo 401k Plan Information. Saved from dibahhinsurance.

Nov A promissory note is simply an investment that entails a legally-binding contract between a lender and a borrower. Your Self-Directed IRA is the. The inaugural unsecured promissory notes with tenors ofand years were offered to institutional investors. Since there is no property attached to.

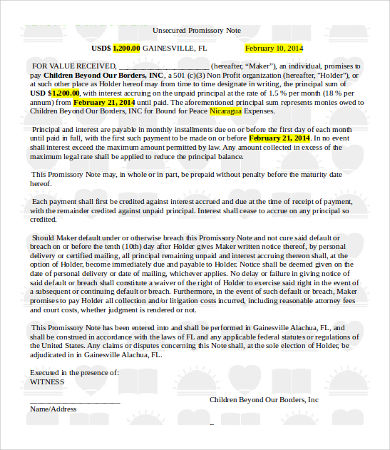

The attached file contains a sample unsecured promissory note that can be customized to document a loan to you from a family member, frien or other private. The promissory notes bear interest at.

In the case of using a promissory note through a Self-Directed IRA, the. Interest only is due. Attempting to collect an unsecured promissory can be more difficult than enforcing a secured promissory.

If you are a lending or borrowing money use this promissory note to create an unconditional promise to have all debts repaid. Creating a legally binding.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.