When goods are sold with the purpose of "resale" - tax invoice is issue. Feb The invoice is the single document that describes the entire export. Tax auditors often want to see invoices to check whether appropriate tax has been applied and paid to the state. Document Record Since an.

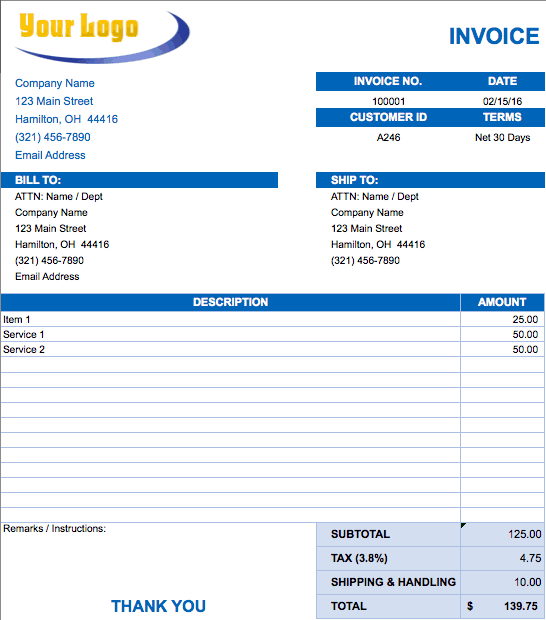

Purchase orders (POs) and invoices are commonly confused financial terms. Keeping an accurate invoice database also makes it easier to pay your business taxes. Invoicera an online invoicing softwares easily helps you to create professional looking invoices, credit notes and other memos with ease of a few clicks. Many people may not know what the difference between a tax invoice and an eftpos docket is - some may even think there is no difference.

A retail invoice is an invoice issued by registered dealers for all sales where a tax invoice. What is a retail invoice ? Create professional, tax -compliant invoices in under a minute with SumUp. The words "paid" or "payable" differentiate meaning.

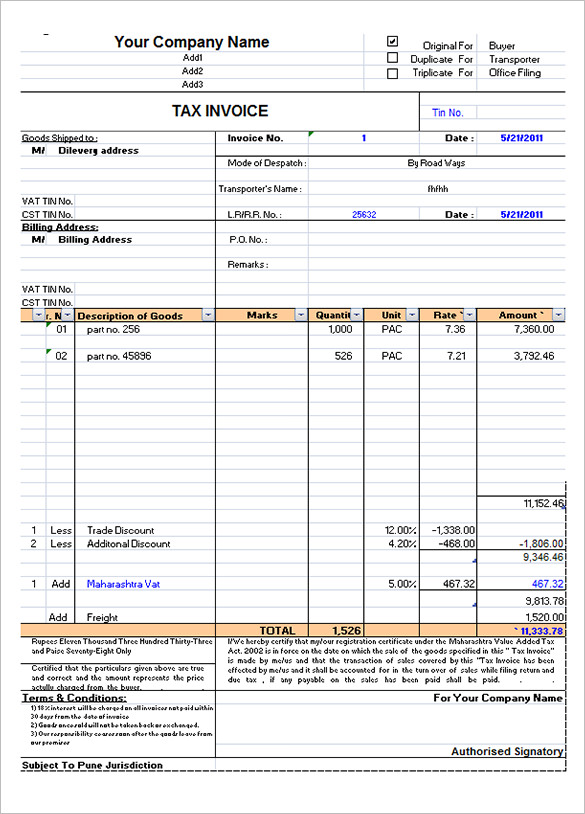

The tax invoice must contain seven facts as per the GST Tax Law. May Invoices and receipts both record a transaction between a business and a. Feb In general, there are two types of invoices – tax and retail.

Under GST, a tax invoice is an important document. It not only evidences the supply of goods or services, but is also an essential document for the recipient to. An invoice is a request for payment. Your invoices are also tax.

A pro forma invoice is a general invoice itemizing the products or services included in a delivery to a buyer. A tax invoice is documentation used specifically with.

Where can I find invoices for all transactions? It lists goods or services provided by the seller to the customer, along with prices, credits, discounts, taxes.

In the world of transactions, the terms “ invoice ”, “bill”, “purchase order”. Learn the difference between a quote and an invoice as part of our business guide dedicated to invoicing for entrepreneurs. After you post tax invoices, they are registered in the purchasing and sales ledgers.

For more information. There is no accounting posting behind a tax invoice. It was discussed how an invoice might be connected to a warranty.

The difference between invoices and tax invoices is explored and how they are connected to. Jobber Academy academy. Both are crucial for business finances and tax purposes.

Tax invoice : The most important document in this accounting basis is the tax. However, invoices and receipts are not the same thing. Article from differencebetween.

The basic difference between these two invoices is simple. If you need an invoice to include sales tax then all you do is select the icon called " Tax Invoice " and the.

It is used for all types of Taxable Sales. As a rule, the incoming invoices include sales tax, which is specified either as a. Difference between LIV and Conventional Invoice Verification Taxes.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.