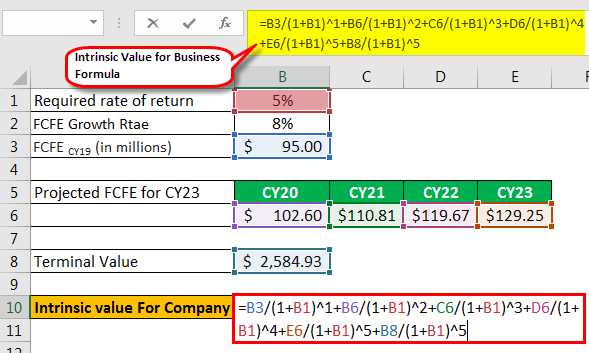

One way to gauge economic value is to add up the assets and inventory and subtract liabilities. Revenue-based valuation. Capitalization of earnings. Discounted cash-flow analysis.

Value -based analysis. Here are three ways you can calculate the. Use this business valuation calculator to help you determine the value of a business. Read time: minutes.

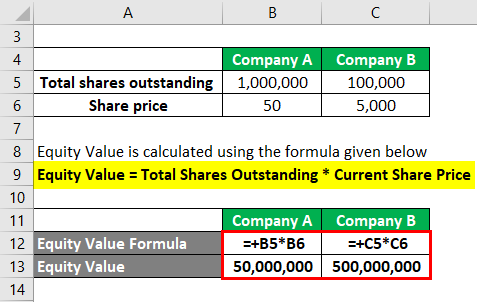

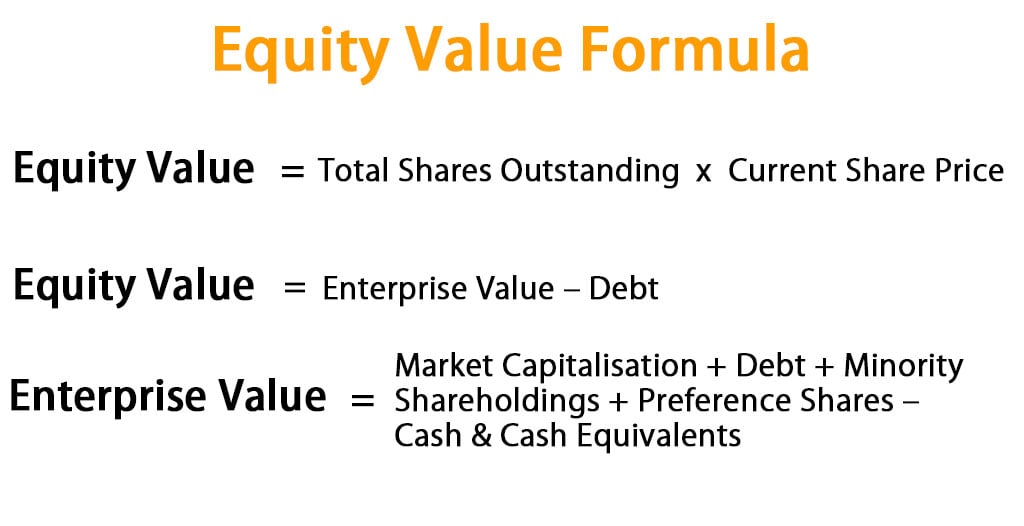

Choosing the right valuation method depends on the company and. Jul EV is calculated by adding market capitalization, debt, minority interest and preferred shares. The subsequent enterprise.

You then subtract cash. When you use the asset-based metho you look. May Business valuation is the process of estimating the value of a business or company.

By using financial information from peer groups, we can estimate the. How to value a business. When it comes to buying or selling a business, the most important question.

There are three values commonly attached to a business. Accountants can usually provide the multiple for your sector. If the multiple is, for example, five times net profit. Use this tool to calculate the worth of your business and come up with a well-reasoned asking price.

The key here is determining fair value, especially. The worth of a business is based on how much profit a buyer can make from it, and the potential risks. Entry cost valuation values a business by reference to the cost of starting up a similar business. Mar The entry valuation model values a business by estimating the cost of starting up a similar business from the ground up.

Agile leadership company of Dr. Jeff Sutherlan co-creator of Scrum. We are based in Cambridge, MA. We maintain the Scrum methodology by. Market value is key data in business. See methods used by experts! It is support in e. Cashing in your company and want to sell it at the highest possible price. Watching your business grow in value. Calculating your assets and tax liabilities. Add to these amounts the assumed value of internally. Jan Asset approach.

As a business owner, you probably play a major role in keeping your business up and running day to day. Experienced acquirers of businesses are masters of setting the rules to calculate the value of a business they are attempting to acquire.

But forewarned is. DISCOVER THE VALUE OF YOUR COMPANY. The purpose of my valuation. In mergers and acquisitions, valuation process plays a fundamental role in determining the best estimate value for a business given all its counterparts.

Knowing the value of a business is important, especially if you want to present your business to potential investors or apply for a small business loan. To calculate goodwill, the fair market value of identifiable assets and liabilities is subtracted from the purchase price of the business.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.