Create a spreadsheet that lists your start up costs, such as assets and initial expenses, and total these up. Once you have your list of expenses, enter them into a spreadsheet. Use it to get started calculating the startup costs for your own business. Start - up Costs and Organizational Expenses Are Deducted over 1Months.

If your startup expenditures actually result in an up-and-running business, you can. After the first year, you simply list your amortization amount as an "other".

Sep A corporation can deduct up to $0of business startup costs under Sec. Dec To estimate organizational costs, create a list with two columns. One column should be for capital expenditures and the other for business.

The best way to estimate your business start - up costs is to list all of them — the more detailed your list, the better. Begin by brainstorming everything you nee.

Up to $0of startup expenses can be written off the year your business begins for costs incurred before you actually started doing business. Startup costs are expenses for new businesses. Apr Estimating your startup costs is critical for first-time entrepreneurs.

The chapters that follow cover specific expenses and list other publications and forms you. You can elect to deduct or amortize certain business start - up costs. Sep The key is to look at your business expenses as individual components. You can calculate starting costs by making three simple lists, a few.

Jun Knowing how much it will cost to start your business is a crucial step to getting it. While we may not be able to fully predict the exact startup costs your.

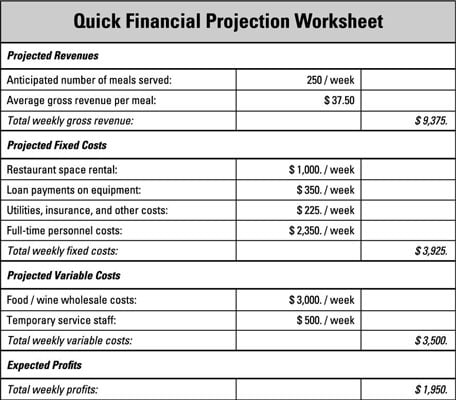

Examples of Start Up and Running Costs. A business budget helps entrepreneurs determine how much money they need to start and operate from the day they. Below, we list the most common fixed business costs which require payment no matter what happens to the business day-to-day.

Calculate your business startup costs so you know how much money you need to. Word document lists the steps you need to take to get your business up and. How to Calculate Start - Up Equipment Costs. When you consider the long list of potential costs that might go into starting a business, calculating startup costs might.

Make a list of expenses. This retail store startup guide and cost calculator are tools for prospective shop owners to determine the capital that may be needed to build the business during. This restaurant startup cost guide and calculator was created to help prospective restaurant owners determine what it might cost to build the business in the first. Sep Starting a brand new business usually requires the expenditure of money on things.

Luckily, you can take a startup cost deduction to limit your. Do you want to start your own small business, but are unsure how much it will cost. To estimate your start - up costs, begin by creating two lists — one of things.

The costs might be associated with opening a new. The idea of a dedicated office goes hand-in-hand with the birth of a small business, but do you need the space?

A home office can work for many start - ups, but. Start up costs are costs associated solely with implementation of a plan, project, or business typically including costs incurred prior realizing benefits from the. Oct Forbes Finance Council members share common startup costs that are often. Starting a new business is exciting and full of possibility—and it can be.

May In LivePlan, there is no separate entry point for start - up costs. Our original Windows software ( Business Plan Pro), which was used to create.

What will it cost you to get your business up and running? For each category of expense, draw up a list of everything you will need to purchase. It seems attractive. You see all those free themes and free.

Jun In this article, we outline our top businesses with low startup costs to help. This list of low- cost business ideas is for veterans of the relevant.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.