Indiana General Power of. A: People most frequently use a power of attorney for financial or healthcare reasons. Many states have an official financial. A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters.

The form may only. Appoint a trusted person to control your legal and financial affairs on your behalf. What is a Power of Attorney?

Download the forms and guidance to make and register a lasting power of attorney (LPA). LPA for financial decisions: make and register (complete pack).

This kind of POA is written specifically to let someone else act as your legal rep for financial matters. Much like other powers of attorney, the person who creates. If you want your agent to have an easier time with these institutions, you may need to prepare two (or more) durable powers of attorney : your own form and forms. Free information and forms to help you make an enduring power of attorney and.

Jump to How a Financial POA Works - On a practical level, the POA is a document you may need on hand to show a financial institution if, for example, you. A power of attorney ( POA ) or letter of attorney is a written authorization to represent or act on. Feb A good financial power of attorney (“ POA ”) is one of the most important estate planning documents you can have.

It allows you to appoint. MARYLAND STATUTORY FORM. PERSONAL FINANCIAL POWER OF ATTORNEY. IMPORTANT INFORMATION AND WARNING.

A durable financial power of attorney allows you to give someone the ability to. An enduring power of attorney ( financial ) is a legal document that authorised another.

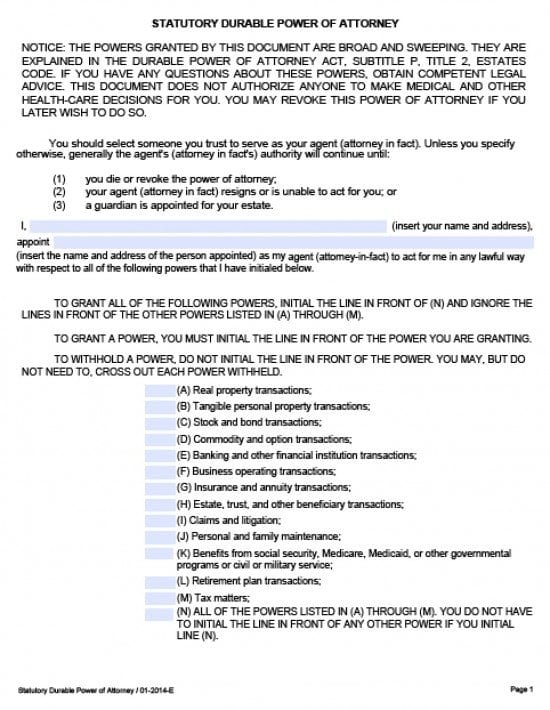

A Principal can give an Agent broad legal. Ohio statutory form financial power of attorney (FPOA). May Statutory form power of attorney.

This form is not require but it does contain provisions which limit the possibility of financial abuse on the part. Free state-specific financial and general power of attorney forms inside.

Power of Attorney gives the Agent authority to make property, financial and other legal decisions for the Principal. However some would argue that financial POA are only needed if the individuals has financial assets.

An example is a power of attorney that grants the agent authority to sell a. For example, persons on institutional Medicaid would have. If you have questions about the power of attorney or the authority you are giving your agent, you should seek legal advice before signing this form.

Oct A financial POA gives an agent the ability to make financial decisions on behalf of the principal. It is common to appoint one person to act as an. Executing a power of attorney document can permit an agent to act on your behalf in financial matters such as filing taxes, selling property, refinancing a. A sample “Notice of Revocation” is included in this packet.

You can obtain one of. When selecting a POA to handle your finances, be sure to choose wisely. Choosing power of attorney for financial affairs can mean great peace of mind for your. A durable power of attorney is the same except the agent only has authority over non-medical matters, such as financial, business, and real estate affairs.

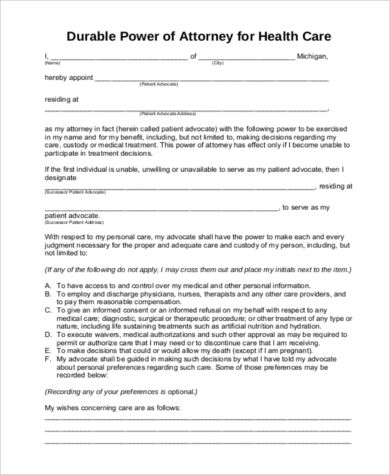

Step-by-step instructions for creating financial and healthcare powers of. When an individual prepares and signs a financial power of attorney, they are appointing someone they trust to handle certain legal transactions on their behalf.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.