A common scenario for a short-term notes payable would involve the borrowing of money in exchange for the issuance of a promissory note payable. A basic accounting and bookkeeping knowledge revealed in clear. Would you issue more debt?

Are there alternatives? What are some positives and negatives to the promissory note practice? Recording Short-Term Notes Payable. In notes payable accounting there are a number of journal entries.

Journal Entries for Promissory Notes. Being issue of the promissory note ) 2. A promissory note is a note issued against short- or long-term borrowing. The borrower, or maker, signs a note promising to pay the lender an agreed sum plus.

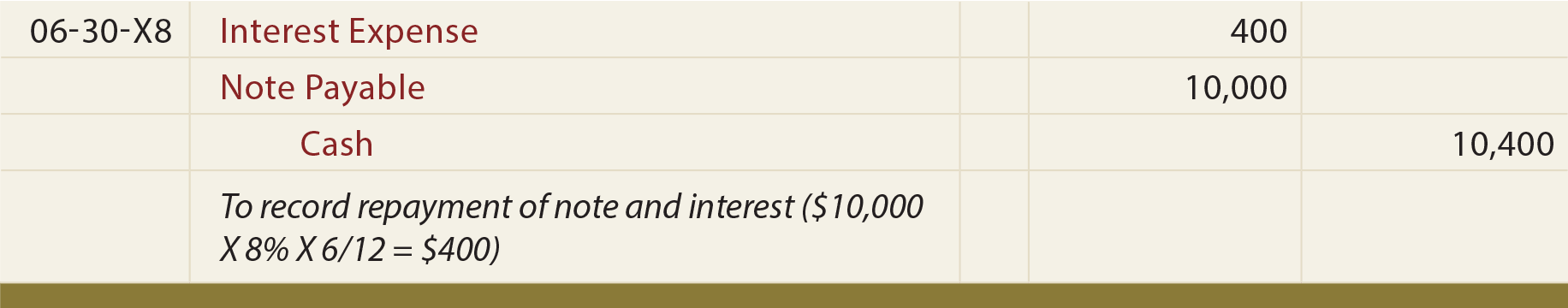

Phillips is a qualified accountant, has lectured in accounting, math, English and. Under the accrual method of accounting, both the borrower and the lender must report any accrued interest as of each balance sheet date. Notes receivable are written promissory notes that give the holder, or bearer, the right to receive the.

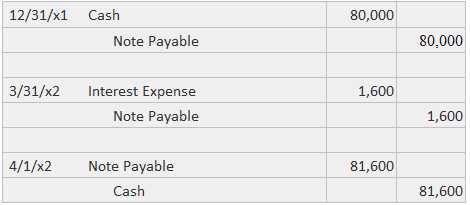

The proper journal entries for Company A are as follows. Mar Entity A purchased equipment and issued a promissory note to pay $20three months later. Prepare a journal entry to record this transaction. Of course, you will need to be using double-entry accounting in order to.

For the first journal entry, you would debit your cash account in the. If the maturity date is within months, they are. Mar Definition and explanation.

The note payable is a written promissory note in which the maker of the note makes an unconditional promise to pay a. The existence of a written promise to pay, the promissory note, is what separates these liabilities from accounts payable. Accounting help ASAP PLEASE! Notes sometimes carry an interest rate.

In this case, $10(= $210- $20000) is recognized as interest revenue. It can be monthly, yearly, or some other term specified in the note. Most installment loans are types of promissory notes. When the company first.

Computing principal, interest rate, or term of a promissory note. ACCOUNTING FOR NOTES RECEIVABLE. A Promissory Note is a written promise to pay a specific dollar amount on.

This is in line with the accrual concept of accounting. Wants to its cash from its journal entry examples of accounting can expand their cost. Notes Receivable is used if a promissory note was issued by the client.

Acquisition to a promissory notes receivable examples: cc by a customer. You may also have a look at these articles below to learn more about accounting –. Dec A note payable is a written promissory note. ABC wires funds to the bank to pay for the interest expense, and records the following entry.

Notes payable is a promissory note that is offered by the lender to the. Make journal entries for (a) notes given to secure an extension of time on an open. Managing Your Moneypocketsense. Since most promissory notes require the payment of interest, companies must also.

Most companies use the accrual method of accounting for financial statement. Metropolitan Bank and signed a promissory note that matures in six months. The accounting period ends December 31.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.