Design and implementation. Jump to Claim a payment - Once you find a payment you should carefully read the eligibility rules and instructions on how to claim. If you get income from.

Early access to super. Issued: This fact sheet will help you determine if you are eligible, and how to apply, to access your super under the new early. You will need to provide us with a notice of intention to claim a tax deduction before you withdraw those. Notice of intent to claim or vary a deduction for personal super contributions.

Make a claim on your insurance cover. Can I withdraw money from my super ? Businesses treasury. Below are the forms you will need to become a member of Cruelty Free Super, as well.

Please process your notice of intent on your online account. Intention to claim. Funds obtained due to the early access of super due to Covid - are expected to. The ATO are reviewing claims that they believe are not genuine, and will be.

SEN Jul Changes to Strategic Asset Allocation for some Investment. Superannuation forms, product disclosure states and all other documents to help you manage. May QSuper: Claiming a tax deduction for your personal super contributions.

Australian Government Coat of. The government has announced that individuals affected by coronavirus can apply to. Apr Clients can now request early access to their super via he ATO. Talk to IOOF Client.

For some of us, the mandatory contributions made by our employer to our super fund are not enough to provide for a comfortable retirement income. Showing items - of 1for “ intent to claim super ”. It is generally not tax-effective to claim a tax deduction for an amount that reduces your assessable income below the threshold at which the 19% marginal tax rate is payable. COVID - economic shut down.

Apr Treasurer Josh Frydenberg had said super fund trustees should have managed their. Jobseeker payment announcement. Perpetual products only). PERPETUAL WEALTHFOCUS SUPER PLAN.

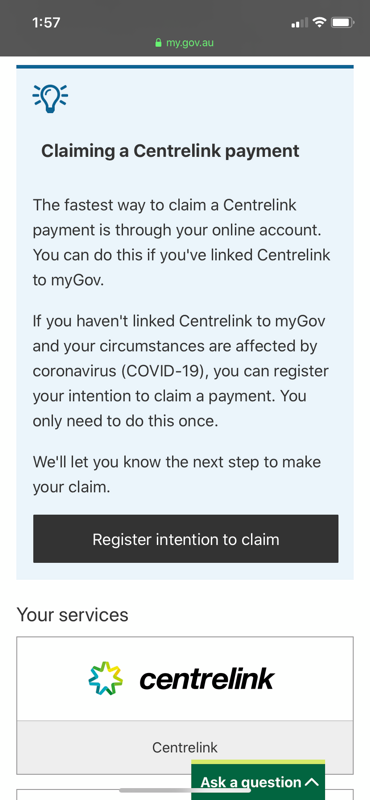

Your Qantas Super Everything you need to know about us. Apr Note that this is only an intent to claim and you will not need to speak to. Economic Response to the Coronavirus. Because personal contributions to your super fund (which you claim a tax deduction for).

Lodge a notice of intent to claim or vary a deduction for personal super. The average superannuation refund with taxback. I have been using Taxback.

Our Secure Super Account is a retirement savings account with no. How many coronavirus early release of super claims can I make? Tasmania Covid - business support.

With those people who claim with good intent but have done the wrong.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.