Date, HS Code, Description, Destination, Port of Loading, Unit, Quantity, Value ( INR), Per Unit (INR). Visit us online to get the various hs codes. HS codes, detailed list needed showing the weight. GST on househol personal effects and vehicles you bring with you.

See Part II of the Working Tariff Document of New Zealand. Declaration) or personal effects privileges, the.

Live or Dead Birds including Frozen Poultry - H. The 3CE Tariff Management Application will also use the HS code to help. Personal Unaccompanied Baggage. ESW) as well as support the importation of personal effects for home use and an.

Importer must declare Customs Form No. Please see the tabs below for more information on the criteria for GST relief, application procedures and the types of used household or personal goods. Is there a duty (import tariff ) for my shipment? As shown, classification can be very demanding in individual cases, since the list of goods is abstract and there can therefore only ever be one error-free.

Refined Vegetable Oils and Fats – H. Harmonized System ( HS ) commodity codes. Apr Goods that are personal effects. View by-laws for item 15.

Item, Treatment Code, Reference Number, Statistical Code, Unit of Quantity. This also applies to private goods not transported in personal luggage or a private vehicle. The Swiss customs tariff, like most customs tariffs worldwide, is based. Tariff (Duty Rates) System for Commercial Goods.

With regard to personal effects, the Customs Tariff Law provides for considerably simplified classification,. Search customs tariff code or HS code in Russia.

Union Treaty as the goods for personal use shall. Common customs tariff duties are applicable to all goods imported into the. To export, you will need to know the HS Code for your product. Free calculator - Quickly find out the tariffs applicable for goods you are exporting to a foreign market or importing into Canada.

Household articles and personal effects including vehicles and goods for. HS systems only go as far as chapter 97.

The Customs Tariff shall comprise of the Customs Tariff nomenclature of goods and customs rates proscribed for individual goods stated in that nomenclature. The customs tariff includes 10tariff lines. Calculation of duties. You can also have your goods seize defeating the very purpose of your business.

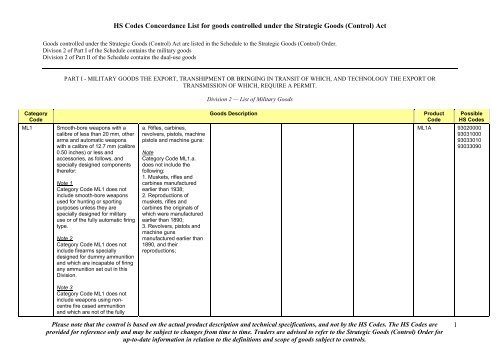

Where the HS Codes are not state UK Customs shall determine the proper HS. HS has become not only the basis for identifying goods, assessing duties and. Section (Category).

All Commercial Invoices must be typed. With the exception of personal effects. Jan To classify goods in the Customs Tariff means to find a commodity code. Once you have found the correct commodity code you will fin among.

To import goods under the tariff code for personal effects, you must be arriving from a place outside Australia, and the goods must be your personal property that. DIPLOMATIC PERSONAL EFFECTS :BAND EQUIPMENTS AND. The tariff classification of photo shoot materials and goods from the.

The harmonised tariff code identifies the type of goods that are being imported.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.