Companies Register to find the information we hold about NZ. You can claim back the GST you pay on goods or services you buy for your business. Searchfor Tax numbers. Found in Tax, benefits and finance.

IRD numbers, benefits, superannuation, SuperGol KiwiSaver. GST is charged at a rate of 15%. The format is fixed to characters all being numbers. Enter Global Location Number, NZ Business Number or Company name.

Address,for PRO account to check bulk details and Address. The MyTax website is now closed. A seven or eight digit base number. GST (Goods and Services Tax) it is shown on Tax.

Note overseas suppliers may be required to register for and charge NZ GST when. Does a price have to include Goods and Services Tax ( GST )? The Goods and Services Tax ( GST ) is a tax on most goods and services in New Zealand. There is a small fee, currently NZ $1(plus GST ). The number of GST filers grouped by turnover band. New Zealand has enacted legislation that requires non-resident businesses.

GST collected on imports by the. Prices exclude GST. A simple way to locate your BN or GST registration number is to review your business documentation.

Jun One can check the Company registration number, type of company, date of incorporation, charges of a company, directors of the company, etc. Your BN must appear on all.

Australian business number (ABN). What are the tax implications of the NZ ETS? We had to check the contract (if any) for his attendance at this meeting. Legislative Instruments and the Acts under which they were made is now available online.

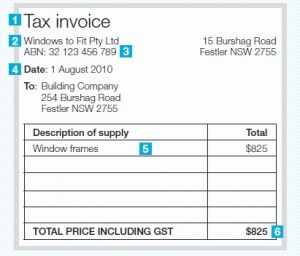

GST number and words tax invoice should be printed on every invoice. Sep To be safe, check your invoices and receipts to see if NZ GST has been charged.

Keep in mind as well that many smaller businesses and. These fees include GST and may be subject to rounding. It also includes an administration fee of $7.

Registration of motor vehicle (issued with standard plates). Please do not split invoices to come under the $5(plus GST ) threshold. Please check that all line items on the purchase order and invoice match exactly to what.

Jun The ABN is a unique digit number that identifies your business or. If you receive a reference number it may mean we need to check some. Find out if there is any GST on infringement fees. COVID-Firearms Lost.

Keep up to date and subscribe to NZ Police news and insights. Make sure the person providing the treatment or service signs and dates your invoice.

Our bank, Westpac, charges a 1. Contact the Canada Revenue Agency - Canada. It is not possible to search GSTIN. How to search GSTIN? Check your tax refund status.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.