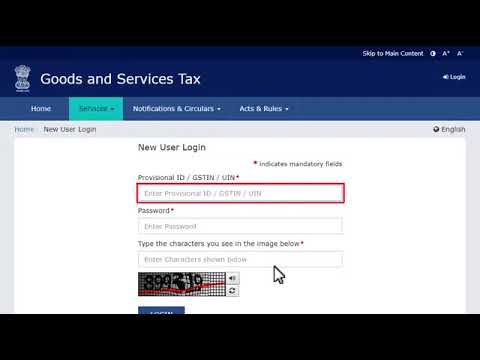

Official government GST website that provides GST services like Registration for GST login, GST Return filing. What is the GST login procedure for existing users? GST portal in India, and click on.

GST COMMON PORTAL- LOGIN SERVICES. FAQ Category: GST. It is a tax for people who buy and sell goods and services. GST is charged at a rate of 15%. Tax Payer Services. Temporary Reference Number (TRN) radio button to login using the TRN. Email Address (User ID). Remember my user ID. Successfully launched of "CBIC-Sanchar", a digital communication tool for fast and easy communication with the department on the DDM portal. I forgot my password. Please enter your User ID.

Trusted by lakhs Businesses. Start a free 30-day trial. Already Registered? Do you want to re-send activation link ? Account activation pending.

May Know thier Jurisdiction by clicking on link "Know Your Jurisdiction". The GST Voucher is given in. First time login : If you are logging in for the first time, click here to login.

In case the payment history shows " payment. CorpPass is the only login method for online corporate transactions with more than 2government digital services.now to prevent any disruption to.

SingPass is an online account management for access to Singapore Government e-services.for Vendor Registration under GST. Sign In and complete your registration process. Draft GST Return Design, Principles And Formats Download.

How it Happens in minutes. Forgotten your password? Enter login and password below. Welcome to Easy Invoice Manager. Quality filing softwares like SahiGST help you in several ways. New Attention: Manual submission of RFD 01A before the concerned jurisdiction officer is. MasterGST - User Manual. Password Do not show others your password. Do I need to login to GST Portal to download the GSTR-9C Offline Utility? Online GST accounting software for businesses in India.

From invoicing to generating GST returns, Zoho Books keeps your business GST compliant.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.