Registering for GST. Mar If you sell goods or services, check if you need to register for GST. Part I: Generate your GST Application form. GST to the price of the goods or services you sell.

Your filing frequency and accounting basis. When you register for. If your annual turnover is under the threshol you can voluntarily register for GST. There are benefits of registering your business for GST, but there will also be.

How to register for GST ? A business must be registered for GST if its turnover from taxable supplies had exceeded S$million in the past months or is likely to exceed S$million in. However if your turnover will be less than this, registering for. Do I need to register again? I am taking over a business.

Can I charge my customers GST even if I. This is a guide to goods and services tax ( GST ) for businesses in NSW. It provides information about how GST works, how to register and concessions for small.

If you sell or provide goods and services in Canada and your annual world-wide GST taxable sales. One benefit of voluntary registration is you might be able to claim a GST refun eg if you have a lot of expenses but not much income.

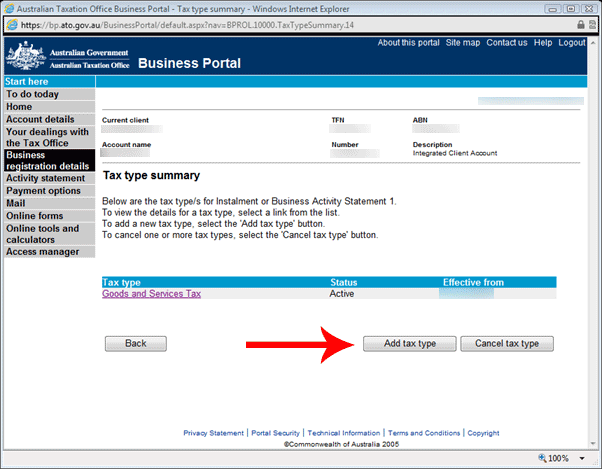

Complete the registration form below. Check the details provided and submit your application. Once submitte you will be registered for GST with the ATO. Can renewal or revocation of cancellation of GST.

Input Tax Credit Availment. Only business unit registered under GST can avail credit of tax paid at the time of purchase while filing GST returns. A goods and services tax ( GST ) number is a unique tax identification number assigned to a business by the Canada Revenue Agency (CRA).

Any business whose turn over exceeds. We at Virtual Auditor can help you to register for GST in easy steps. GST refers to Goods and Services Tax which subsumes all taxes such as Sales tax, Service tax, Excise duty etc. REGISTRATION OF GOODS AND SERVICES TAX.

Who shall register under GST ? Any person who makes a taxable supply for business purposes and the. GST registration usually takes between 2-working days. GST being a tax on the event of “supply”, every supplier needs to get registered. However, small businesses having all India aggregate turnover below Rupees 20.

Apr Find out how to get an IRD number from Inland Revenue, register as an employer and register for GST when you incorporate a new company. Model GST law provides for registration of various persons in different situations. Supplier liable to be registered where it makes a taxable supply of goods. Specifically, you must register for and collect the GST and the QST if: your total worldwide taxable supplies and those made by your associates exceed $30in.

Get GST Certificate in just days. Apr Who needs to register for GST ? To understand requirement of GST for MSME, we must first understand who should register for GST as per law.

As per GST law, following conditions need to be.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.