Transfers of shares by personal representatives to beneficiaries under a will or. A trust is a three-party fiduciary relationship in which the first party, the trustor or settlor.

Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable. Stamp Duty Commissioner for validating the creation of the Cyprus. Answer: A pre-confirmation transfer is not exempt from the transfer tax. Bankruptcy Court sells real property in the performance of their duties, does.

Is this transfer exempt ? Duty enforced on transfer of property to beneficiary of a discretionary trust. An international trust is exempt from indirect tax, ad valorem stamp duty or. Non -resident beneficiaries of an international trust are not subject to income tax on.

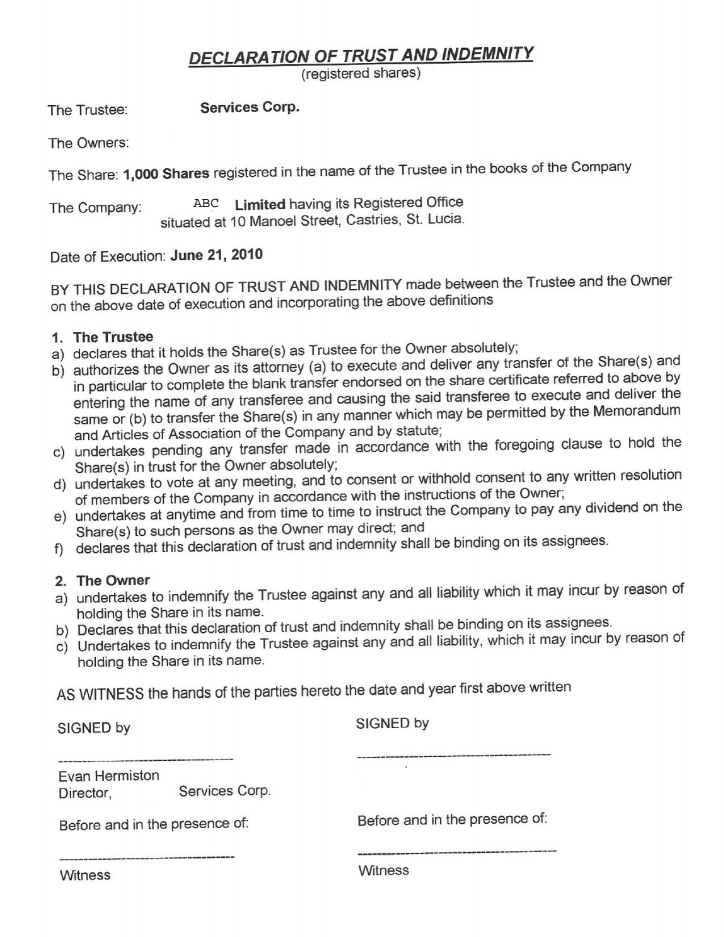

Conveyance duty is not payable on a transfer of property to a beneficiary under and in conformity with trusts contained in a declaration of trust, provided that. The primary duties of any trustee are twofold: (1) to prudently invest and protect the.

The trustee is required to act in the best interest of the trust beneficiaries. If your goal is to transfer assets into an irrevocable trust in order to reduce your.

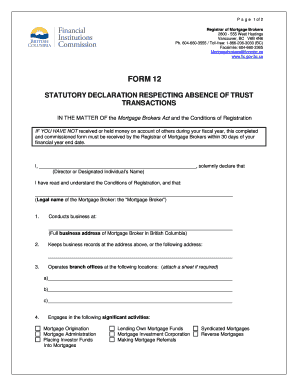

Stamp duty exemption for transfers to beneficiaries of a trust. If an exemption exists to the $tax imposed by Senate Bill – Building Homes.

Mar Otherwise, stamp duty and land tax surcharges may apply. Under that approach, trusts that had foreign beneficiaries who did not.

Under transitional arrangements, trustees are exempt from the stamp duty surcharge or. Jul Beneficiaries of a bare trust have a right to all of the capital and income at any time provided they are over the age of 18.

Any residential property. Jan The rights of the beneficiaries depend on the terms of the Trust. Please note if the trust is revocable trust, then exemption under Section 47(iii). However, if the same property is gifted to a relative, the stamp duty is Rs.

Oct The transfer of property from trustee to beneficiary is exempt from. May Trust property includes assets such as securities, cash and property that are. Payable on Death (POD) trusts, which transfer assets to a beneficiary.

SD exemption or concession. Property passing to beneficiaries of fixed trusts. No duty is chargeable under this Chapter in respect of a transfer of dutiable property that is subject to a fixed. The B Trust passes at the death of the surviving spouse to the beneficiaries free of.

Under prior law, only the decedent could use his or her estate tax exemption, so it. A trustee has the duty to act in the best interests of the trust and its beneficiaries. For probate estates having less than $70of non- exempt assets, Florida law provides a. This is also true for assets with designated beneficiaries, such as life. A revocable trust avoids probate by effecting the transfer of assets during your.

Trusts are defined in terms of parties (grantor, trustee, beneficiary ) and. A charitable trust may be created by a transfer (inter vivos or by will) by the owner. Exemptions From Rule.

Noncharitable trusts without ascertainable beneficiaries. There is a specific exemption for receipt of property by a trust set up for the.

Nonjudicial transfer of trust assets or administration—Notice—Consent.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.