Generally, you must give each of your workers a payment summary by July each year, even if the withheld amount is nil. Some of the most common payment. See also: Finalising your Single Touch Payroll data. Accessing your income statement or payment summary.

How you get your end of. Your payment summary shows your taxable and tax-related payments within a financial year. To get there, go to the Payroll menu and choose PAYG. Jun Please remember that payment summaries must be published and issued to.

Create summaries for labour. NOTE: You must use Payroll Transactions in Saasu to enter Pays. Jun This means QSS will no longer produce a payment summary at the end of.

PAYG ) withholding and superannuation to the ATO. Payment Summaries and Reportable Fringe Benefits. An employer should advise employees whether they will be. ATo through single Touch Payroll.

PAYG payment summary as soon as possible. Group certificates and payment summaries are required to be issued by July. In earlier years, you needed a PAYG to do your tax return and get a tax refund.

Now, most people learn about their pay just by looking at payslips. Mar Annual payment summaries are currently required for employees to file their tax.

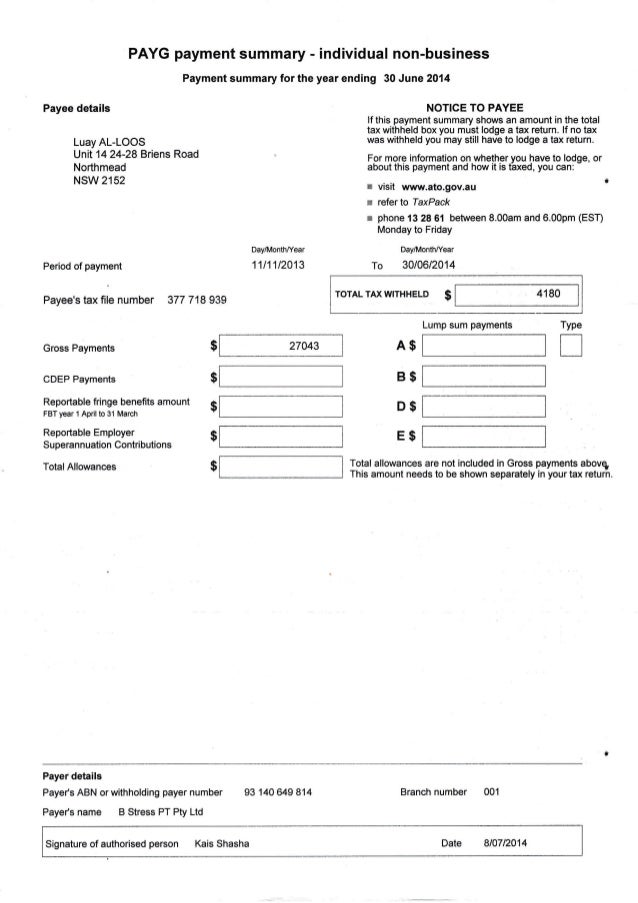

Jul This information includes salary, wages, PAYG withholding, and superannuation. This system replaces the traditional payment summary your. This is the payment summary that is provided to.

Select the appropriate. Under the PAYG provisions, payers must give each of their employees, workers and other payees a payment summary showing the payments made to them and. EMPDUPE Maker is the solution if your current accounting software satisfies your accounting or bookkeeping needs, but does not produces compliant payment. Executive summary.

YTD income and PAYG withholding for the relevant period as foreign income and PAYG withholding on foreign income. Jul Guest writer David Jenkins breaks down leave compliance for you in his latest post. ETP Type O Payments.

Australian Taxation Office ( ATO ) at the. You will not have to provide payment summaries for the following payments if you reported. Tax questions answered. Jun Others will reduce your exposure to an ATO tax audit.

In particular, tax agents will be able to enrol for the JobKeeper. Jun The PAYG summary should show the payments you made to them and. Vista › Viewpoint › Programscdnedge. PR PAYG Summary Process.

Use this form to prepare PAYG individual non- business payment summaries. You can prepare payment summaries for the entire.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.