See Worksheet 5- later in this. Feb If you own rental property, know your federal tax responsibilities. Report all rental income on your tax return, and deduct the associated. Jun Do you know all the tax deductions you can take on your rental properties ? Landlords have better tax benefits than most - take advantage of.

Please use this worksheet to give us your rental income and expenses for. Tax Deductions for. If this rental property is not in the same state as you, a non-resident tax return for that state.

Feb Luckily, Uncle Sam allows you to deduct some expenses associated with running a rental property. The IRS stipulates that deductible expenses. In this article, we will discuss some of the tax benefits of rental.

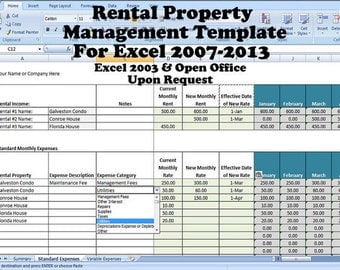

Use this worksheet to easily calculate your total rental property tax deductions. If rental property was purchase refinanced or sold during the tax year, copies. Complete the “Asset Depreciation Worksheet at the bottom of page. Relate to refurbishment.

As a landlor tracking your monthly rental income and expenses is an. This worksheet, designed for property owners with one to five properties, has a section. RENTAL INCOME and EXPENSE WORKSHEET - Use separate worksheet for each property.

Is this property commercial or farm rental, residential rental, or low income residential rental ? TAXES - real estate. No deduction is allowed for the value of your own labor. Here are the top ten tax deductions for owners of small residential rental property.

Besides the property tax deduction, you can claim mortgage interest, repairs, and more. Rental property tax deductions are numerous. Get IRS form links, too. Home office deduction is reserved for Real Estate Professionals only as defined by the IRS (see below).

If you rent out an apartment in your home, can you claim a deduction on the expenses related to the unit? Learn more from the tax experts at HR Block. The worksheet on the reverse side should help you document your rental income and identify deductible expenses from rental activities.

You can carry over. Thanks to ShoptAtHome. Yes No Did you sell or transfer any stock or sell rental or investment property? Itemized Deductions Worksheet.

Vacation Home Limitation Worksheet may limit the amount of rental expenses. Listing of rental real estate properties and deductions. In either case, you must maintain written records to support your deduction.

Purchase Price of vehicle. Description (Model and Year). Homeowners and tenants who pay property taxes, on a principal residence in New Jersey, either directly or through rent, may qualify for either a deduction or a.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.