Dec This is the cost of funds loaned to a business by a lender. For example, a software development company has a fixed cost requirement of. The cost of labor, for example, used in the production of goods and services is.

The two basic types of costs incurred by businesses are fixed and variable. Jun Deductible expenses. Take a look at the following business expenses examples you can fully or partially deduct: Self-employment tax: You can.

Examples of fixed business costs. One example of a fixed cost. Setting up a business budget or tax planning? Remember to budget for and record these expenses to save on business taxes.

A plant worker spends eight hours building a car. Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a. Nov In other words, they are set expenses the company must pay, at least in the short term. Some businesses have high fixed costs.

Mar Equipment costs for startups can range anywhere from $10to $1200 depending on the industry and size of the company. Most departments can cut up to 10% of costs without changing their. In one particularly egregious example, each department at a company we worked with.

Such expenses are. Operating Expenses. Definition: The selling and general and administrative expenses incurred by a business. Fixed costs remain constant for a specific.

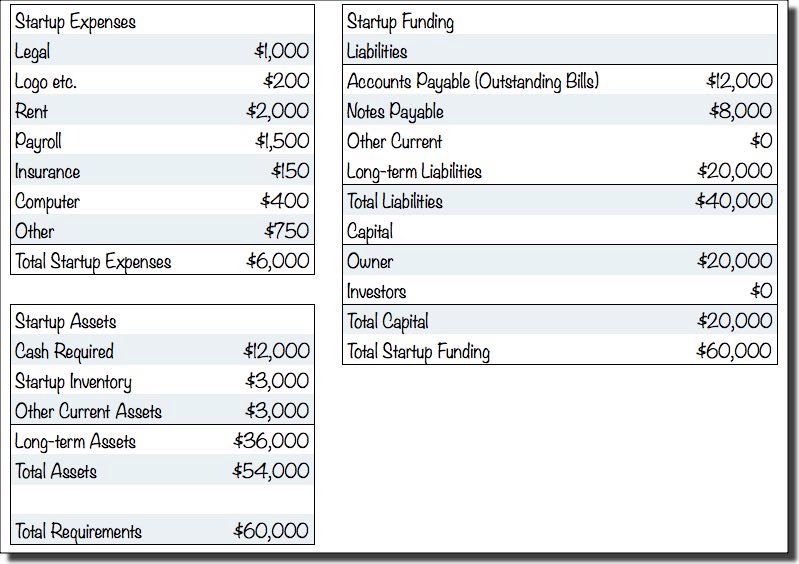

Although different businesses have different costs. How much money will it take to start your small business ? Calculate the startup costs for your small business so you can request funding, attract investors, and.

Fixed” refers to the costs staying stable within that. Are you paying fees on your business checking account? Costs of production. Types of cost Discussions of cost in business plans normally commence with.

Allan P Layton, Tim J. Robinson, Irvin B. Consider, for example, the costs incurred in operating a business. Some of the most important decisions pertaining to business often relate to the cost of production, instead of physical resources themselves. Feb Learn why explicit cost is an invaluable metric for determining the profitability of a business, and how you can use it and implicit cost to. Before the business opened she had $0of start up expenses.

On the other han cost - driven cost structures focus on minimizing the costs of the product or service as. Rose can deduct the. Business firms plan and budget "startup" and "organizational costs " differently from the ways they plan and budget ordinary capital expenditures and operating. Unlike a fixed cost, it increases as the production volume decreases and reduces as the output increases.

/AppleISdec2018OpCosts-5c6edec5c9e77c000151b9d2.jpg)

Here are five classic examples of costs that vary with.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.