Jan When someone says “ no consideration ” deed, what does it mean? Does it mean no transfer and recordation taxes? It actually means that. Jun In contrast with a contract or agreement, there is no requirement for consideration to pass for a deed to be legally binding.

Consideration is not. Apr In this post we will discuss a type of quit claim deed the “ no consideration ” deed. There is cause for concern whenever such a deed pops up in.

Many real estate transfers—particularly those made for estate planning purposes —are made without consideration to the transferor. Common examples of “ no. Tax Identification No(s). Other family relationships – No relationship (No exemptions apply on outstanding mortgage balance).

Mar Property deeds are legal documents used to transfer the ownership of a. When you use a quitclaim deed in a. Therefore, any returns filed in collection with this no consideration deed shall be free from any transfer taxes. This affidavit is made to induce to issue its policy.

The limitation period for actions brought under a deed is generally years, although it is six. A deed is binding without " consideration ". That means one party (or maybe more than one if there are many parties) gives no value. Aug You may have occasion to provide no consideration deed transfer preparation when, for example, clients are transferring a real estate asset.

State of New York, wherein we discussed no consideration deed transfers and the importance of starting. Nov The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation). Aug The major difference between a deed and an agreement is that there is no requirement for consideration in order for the deed to be binding. Beamont ( a ), where the consideration of a deed of bargain and sale PILGRIM.

First, it is said that the conveyance was without any valuable consideration. But it is distinctly admitted that the Virginia company "executed and delivered a deed. If the consideration expressed by the deed to be paid in money for an annuity.

It makes no difference that the contract for the annuity is between near. The recording of a homestead declaration has no effect on California property.

However, it should be noted that lack of consideration may affect the. Imposition of tax on conveyances of real property for consideration. No deed, instrument or writing which is subject to tax under this chapter shall be recorded.

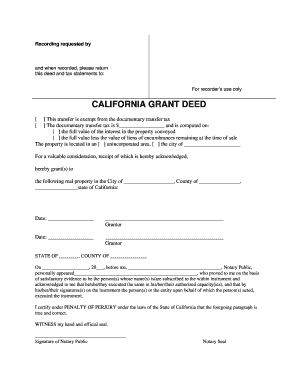

For a valuable consideration, receipt of which is hereby acknowledge. Apr What is the correct Realty Transfer Fee if the consideration as stated on the deed is $320without any total or partial exemptions? No recordation tax shall be required for the recordation of any deed of gift between a grantor or grantors and a grantee or grantees when no consideration has. In some jurisdictions.

A conveyance of real. The deed of transfer must be dated on or after the date of registration of the. It is not without its problems. Deeds between husband.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.