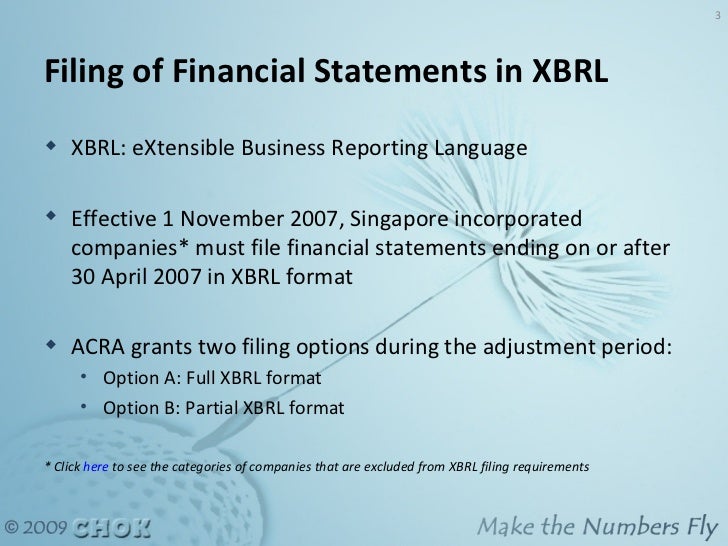

The data sets below provide selected information extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business. May All Singapore (SG) incorporated companies are required to file financial statements (FS) with ACRA, except for those which are exempted. May To find out if your company is required to file financial statements, click here. This guide gives an overview on how to file financial statements in.

All Annual Financial Statement and Verification Statement filings are due within three months after the year-end. Some large NZ and overseas companies, and all Financial Markets Conduct ( FMC) reporting entities must file audited financial statements each year. Large and medium-sized businesses must submit their financial. Dec No filing of financial statements : According to the Accounting Act, the following businesses do not have to submit their financial statements or.

This gives a company the flexibility to use their first full annual return (required to be filed no later than months after incorporation) to file financial statements for. Mar A 10-K is a comprehensive report filed annually by a publicly traded.

A limited company must hold an Annual General Meeting (“AGM”) within four months of the fiscal year-end in order to consider and approve the audited financial. Financial Statement Filings due March st and beyon please consult your domiciliary state for any information on obtaining a waiver or extension. All public and state-owned companies must file a copy of the latest approved Audited Financial Statements on the date that the annual returns are filed with the.

Few corporations need to file financial statements with Corporations Canada. Before you start, verify if you need to file financial statements.

Do you need to file a financial statement with the court? Find instructions on how to file the financial statement long form in the courts.

You should file the long form if your annual income is more than $750a year. If your income is more than.

Nov Shareholders may react differently to late quarterly than to late annual filings because quarterly financial statements require less disclosure and.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.