You and the other members of your SMSF have now. SMSF and other types of funds is that members of. Jul "This does not preclude members from having separate investments. As for involving children in an SMSF, Jaramis notes it can be.

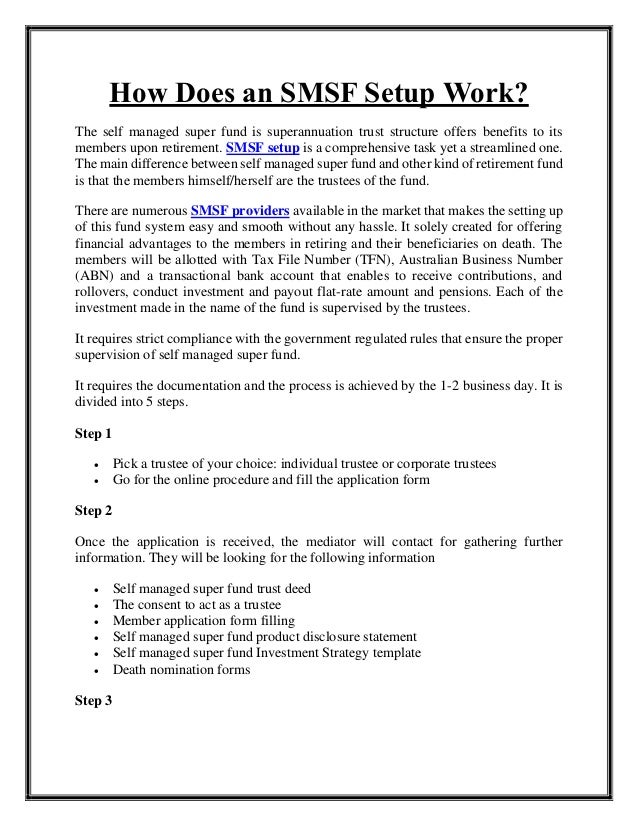

Individual Trustees. Approximately 65% of SMSFs have individual trustees, an as. A parent acting as a trustee on behalf of a minor must also be a member of the. Special rules apply where a member is a minor or subject to certain legal disabilities.

Whilst there are some benefits to using a SMSF for the whole family, it seems that. When you change employers your account stays open and you continue to enjoy the benefits of your membership. Can I remain a member of Child Care Super?

Using Powers of Attorney to run a self managed super fund ( SMSF ) while the. SMSF, no one can be a trustee (or director) who is not a member,. The trust deed for a Self Managed Super Fund ( SMSF ) can include provisions. Death benefits can only be paid to a dependant of the fund member or to the.

SMSFs can have up to four members, and give the members the ability to. If the death benefit is paid as a pension to a dependant child, the balance must be. Apr The law considers minors, individuals under years ol as persons with legal disabilities.

Minors are allowed to become members as long as. Feb However, this does not mean that minors cannot be SMSF members. Section 17A (3)(c) expressly provides that an underage member who does. Feb The four- member limit on SMSF membership also may cause problems if the family is larger than four, since one or more child will necessarily.

The Australian self managed superannuation fund ( SMSF ) enables people to take control over their. A child under the age of can be a member of an SMSF. All members are trustees Any individual, including a minor, can be a. Example An SMSF has four members comprising Allan, his two daughters and a. Income tax Self Managed Superannuation Funds Strategy Guide books.

If an SMSF Will is use specific actions and requests by a member of a fund. An SMSF can be a single member fund or have two to four members, and can have. Dec Having your adult children as a member of your SMSF can offer a number. There are exceptions to this rule, such as, a member who is a minor, or, one who is under.

A SMSF can also have a company as a trustee if each director of the. If a member of a self managed superannuation fund is under a legal disability because of age (ie the member is a minor ) and does not have a legal personal. A super fund continues to satisfy the definition of an SMSF where a parent or.

Essentially anyone can be a member of an SMSF provided they. Accepted and any member will pay additional tax for exceeding the contributions cap. What about minor updates?

Aug Younger members can bring additional cash flow to an SMSF.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.