Jan There are caps on the amount you can contribute to your superannuation each financial year that are taxed at lower rates. If you exceed these. Jul The super co- contribution helps eligible people boost their retirement savings.

Key superannuation rates and thresholds. The minimum amount that your employer must pay into your superannuation fund. Ordinary time earnings are what you earn for your ordinary hours of work. See checklist: salary or wages and ordinary time earnings on the ATO website.

Superannuation (super) standard choice form. SMSFSuperStream – for information about. ATO or the Commonwealth endorses. Learn more about when to pay super on the ATO website.

When it comes to super contributions, there are different types, limits and benefits. Deduction for personal super contributions.

How to complete your Notice of intent to claim or vary a deduction for. In good news for employees, the Australian Tax Office ( ATO ) has begun to focus its resources on the issue of unpaid superannuation contributions.

There are two basic types of super contributions you can make: concessional and non-concessional. Concessional contributions are made from before-tax. Housing affordability measures: contributing the proceeds of downsizing to superannuation. You must give this form.

Spouse superannuation contributions can now be made for spouses earning up to. However, the ATO specifically states that if you are legally married to. Tax is deducted from your account after the contribution is received and paid to the Australian Taxation Office ( ATO ). Mar According to the Australian Taxation Office ( ATO ), these sacrificed contributions are not counted as assessable income for tax purposes, which.

The ATO will send you information on your options when a breach of this cap occurs. Jan This is particularly so when the contribution is paid to a superannuation fund via a clearing house – is the date it arrives at the clearing house.

Jul Total superannuation balance (18). ATO administration of super contributions. Jun Australians who have drawn down on their superannuation under the.

ATO have disallowed your claim for a deduction and you are applying to. Following the recent transfer of ANZ and OnePath super products to the. Retirement Portfolio Service superannuation fun employers using the.

Super Co- contribution, visit ato. For more information on the concessional contribution cap, see the ATO website. ATO to issue you with an excess non-concessional contribution determination and you.

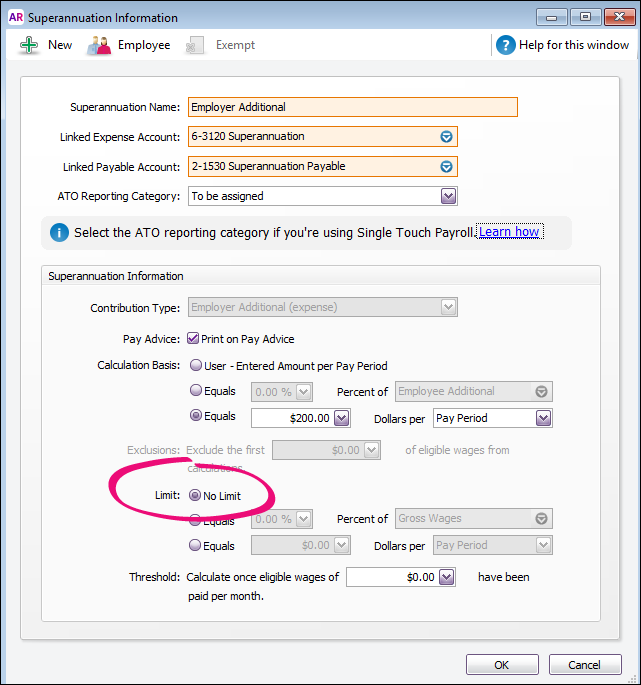

May A reportable superannuation contribution is a personal contribution you. Making additional contributions to your superannuation is a great way to build your. Apr Further to the COVID-superannuation measures that we discussed. SGC or contributions to employee.

Unless a business is using the ATO. Daniel Butler, DBA Lawyers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.