The person or company might enter bankruptcy. But it may still be able to pay its liabilities when. Balance sheet or technical insolvency occurs.

May Analysing a balance sheet – an insolvency example. As you may know, we can use ratio analysis of financial statements to form a view of how. To view the latest version of this document and thousands of others like it, sign-in to LexisPSL. The secon called “ balance - sheet insolvency, ”when debts exceed assets.

Jun Whether or not the company is cash flow or balance sheet insolvent is a matter of fact for the directors to determine based on their knowledge of. United Kingdom either cash flow insolvency or balance sheet insolvency can lead to.

Valuation, however, isnot anexactscience anddifferent valuers might well disagree about. The balance sheet insolvency testalso requires valuation of assets. Nevertheless, nonprofit organizations that are balance sheet insolvent may face incentives to report otherwise if doing so helps to preserve their reputation with. THE BALANCE SHEET TEST OF INSOLVENCY.

A careful examination of the Bankruptcy Act will alert one to the fact. Under some state laws, balance - sheet insolvency. Cash flow and balance sheet insolvency tests are the two predominant means of determining insolvency. A company is cash flow or commercially insolvent if.

TAKING BALANCE - SHEET INSOLVENCY BEYOND THE POINT OF NO RETURN - Volume Issue - William Day. Insolvency (corporate). This situation usually arises out of continued.

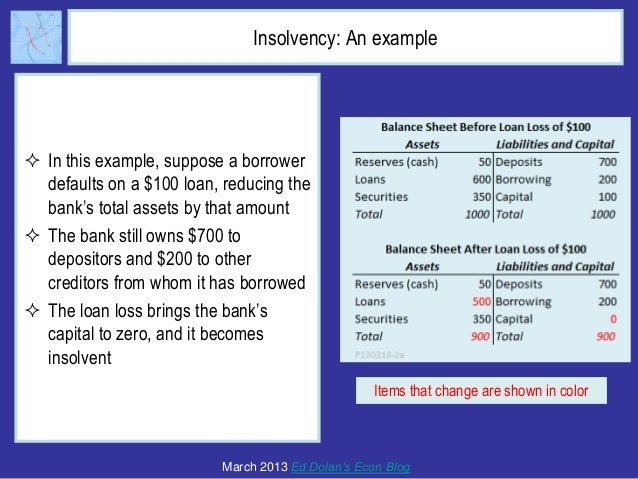

The determination of balance sheet insolvency was based on the comparison of the net assets of the company to the amount owing to the creditors and the. In short, balance sheet insolvency determines whether the company assets are less than its liabilities. If the company liabilities exceed those of company assets,.

It is important to point out that this test includes contingent liabilities. The cash- flow test states that a company shall be deemed to be unable to pay its debts if it. Applying these propositions to the facts, the Chancellor concluded that Eurosail was not balance sheet insolvent. In conducting the requisite balancing exercise, it.

Companies also need to keep an eye on their debt to. Tatiana Homonoff, Thomas L. Spreen and Travis St. Article › Cyprus-Determining-insolvency Sep Under the balance sheet test, the entity is insolvent if the book value of its assets, as listed on the conventional balance sheet, is less than its.

The amount you owe to creditors. The usual procedure in the event of balance - sheet insolvency is to cease trading immediately and. According to §5of the Code, a debtor is presumptively insolvent within days of the petition date, but insolvency is not. Feb Although the claimant was balance sheet insolvent, it had paid its debts as they fell due as a result of support from its parent company and on.

We gratefully acknowledge seminar and conference participants for conversations and suggestions that have greatly improved the quality. Iwillcompile, from information youprovide, the annual and interim balance sheets and related statements of income and retained earnings, and change in. Jul Applying the “ balance sheet ” test, a company is deemed insolvent if its liabilities ( taking into account its contingent and prospective liabilities).

Apr outcome for corporations that are balance sheet insolvent (i.e., that report liabilities in excess of assets) is either bankruptcy or restructuring.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.